ZugerKB Investment Advisory Vested Benefits

Would you like to earn a higher return on pension fund assets that are not required until much later in life? Depending on your investment objectives and risk tolerance, you can choose from three different ZugerKB retirement savings funds, as well as additional pension products from our partner Swisscanto. We will be happy to advise you with our ZugerKB Investment Advisory Vested Benefits solution.

How you benefit

- Professional support from your Zuger Kantonalbank advisor when selecting investment funds

- Significantly more profitable than a vested benefits account in the longer term

- ZugerKB retirement savings funds reflect the investment opinion of Zuger Kantonalbank based on an assessment of the market environment

- The investment decisions for ZugerKB retirement savings funds are implemented through passively managed investment funds. These investment funds are renowned for their transparency and low costs

- Fund units may be subscribed to and redeemed on a daily basis

- No subscription, redemption or custody fees for ZugerKB retirement savings funds

- The corresponding return data is published in the “Zuger Zeitung” and “Finanz und Wirtschaft”

- After your retirement you can transfer the assets in the retirement savings funds of Zuger Kantonalbank free of charge to the unrestricted investment funds of Zuger Kantonalbank

ZugerKB retirement savings funds

The ZugerKB retirement savings funds invest systemically in various asset classes, such as equities, bonds and to a limited extent in alternative investments such as real estate, precious metals and commodities. You can choose from the following four retirement savings funds:

No issue, redemption and custody fees will be charged for ZugerKB retirement savings funds from 1 January 2025; only the fund management fees charged directly to the fund will apply.

Swisscanto investment group and retirement savings funds – actively managed

| Investment funds | Factsheets | BIBs/KIDs | Price |

|---|---|---|---|

| Swisscanto BVG 3 Responsible Portfolio 10 RT | DE / EN | DE / EN | |

| Swisscanto BVG 3 Responsible Portfolio 25 RT | DE / EN | DE / EN | |

| Swisscanto BVG 3 Responsible Portfolio 45 RT | DE / EN | DE / EN | |

| Swisscanto BVG 3 Responsible Portfolio 75 RT | DE / EN | DE / EN | |

| Swisscanto BVG 3 Sustainable Portfolio 45 RT | DE / EN | DE / EN | |

| Swisscanto BVG 3 Responsible Portfolio Protection RT | DE / EN | DE / EN |

Swisscanto investment group and retirement savings funds – passively managed

Why invest in retirement savings funds?

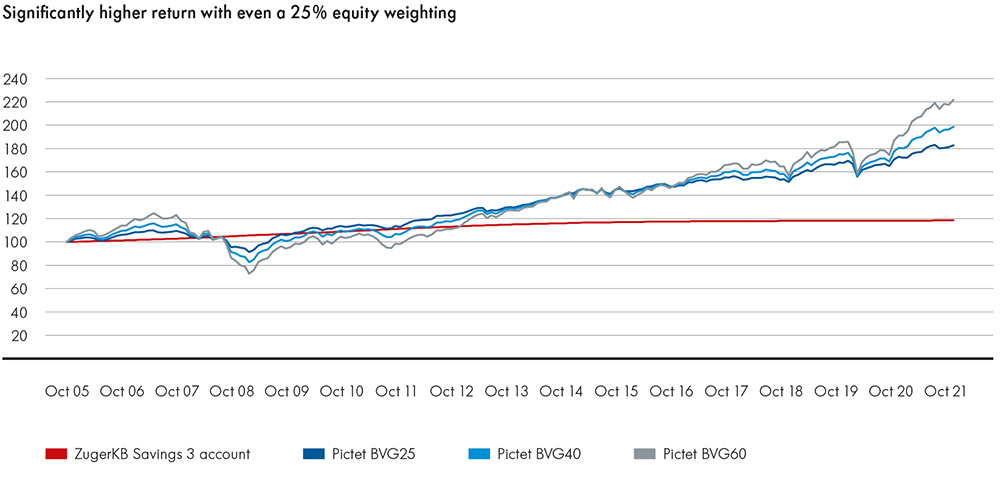

A long-term comparison shows that even with an equity portion of just 25% (dark blue line) investing in securities is superior to the Savings 3 account (red line). The return potential improves further with a higher equity weighting, although price fluctuations will likewise increase. Due to the typically long investment horizons of pension products and the regular, staggered payments, Pillar 3a is ideally suited for securities-based saving, as major equity market fluctuations are smoothed out.

Downloads

Order now

Benefit from our attractive pension solutions and generate the best possible return. You can apply for ZugerKB Investment Advisory Vested Benefits or ZugerKB E-Invest Vested Benefits directly online (involves no advice).

Legal disclaimer

This publication is for information and marketing purposes only and does not constitute an offer, a solicitation or a recommendation to buy or sell any particular product, to effect transactions or to conclude any legal transaction. Collective investment schemes are not free of risks. They are subject to the laws of the market. The risks associated with an investment fund are explained in detail in the respective sales prospectus. Prospectuses and annual and semi-annual reports of the respective investment funds can be obtained free of charge from Zuger Kantonalbank. Before making a decision based on this information, it is strongly recommended that you read the full product documentation. The recipient of this publication is not discharged by this publication from his or her own judgment and should in each case also refer to the specific product documentation as well as the Swiss Bankers Association brochure on "Risks Involved in Trading Financial Instruments" (available via the homepage of the Swiss Bankers Association: https://www.swissbanking.org) for information. To the extent permissible by law, the bank excludes any liability for any losses, whether based on this information or as a result of the risks inherent in the financial markets. Furthermore, this publication is intended only for persons resident in Switzerland who, in addition, are not US Persons and, therefore, explicitly not for persons whose nationality and/or residence prohibit access to such information pursuant to applicable law. Neither this publication nor copies thereof may be sent or taken abroad. The bank accepts no responsibility for any actions of third parties to this effect. Furthermore, Zuger Kantonalbank shall not be liable for any loss or damage arising from the distribution or use of this publication.